Frequently Asked Questions for Main Street Banking

What is Main Street Bank’s Routing Number?

Main Street Bank’s routing number is 211370752.

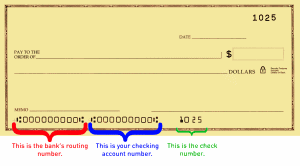

You can find the bank’s routing number, along with your checking account number, on your checks. The first 9 digits are the bank’s routing number, also called an ABA number. The second set of digits are your checking account number. The last set of digits indicate the check number.

If you’re looking to change your direct deposit with your employer, or change your automatic deductions from your account, be sure to take a look at our account “Switch Kit” to make it easier for your to switch your account activity at Main Street Bank.

Where are the Main Street branches located? What are their hours of operation?

For a full listing of all Main Street Bank locations and hours of operation, Click Here.

What are the holiday hours at Main Street Bank?

Main Street Bank is closed during the following holidays:

| Holiday | Branches Closed |

| New Year’s Day | All |

| Birthday of Martin Luther King, Jr. | All |

| Washington’s Birthday (Presidents’ Day) | All |

| Easter Sunday | All |

| Memorial Day | All |

| Juneteenth | All |

| Independence Day (Fourth of July) | All |

| Labor Day | All |

| Indigenous Peoples’ Day | All |

| Veterans Day | All |

| Thanksgiving Day | All |

| Christmas Day | All |

Remember, our customers have access to Online and Mobile Banking, Bill Pay, and Mobile Deposit 24/7 – even during the holidays!

I’m locked out of Online Banking. How do I reset my account and password?

To reset your Online or Mobile Banking login credentials, contact us:

- Call 508-481-8300 at any time for online and mobile banking support.

- Find your branch and call them directly on our Hours & Locations page.

- Use the available contact options under Contact Us.

If I forgot my Online Banking password, can I change it?

If you have forgotten your password for Online and Mobile Banking, you can reset your password.

- Visit the Online Banking login page: https://secure.myvirtualbranch.com/BankMainStreet/SignIn.aspx

- Select “Forgot your Password?”: https://secure.myvirtualbranch.com/BankMainStreet/ForgotPassword.aspx

- Enter the required information to validate your entity to reset your password.

- Choose your new desired password. Your password must have 3 out of 4 of the following criteria: lower case letter, upper case letter, special character, and/or number.

If you are unable to provide the required information to reset your password, you may call our 24/7 designated Online and Mobile Banking support line at 508-481-830.

How do I know the Online Banking site is secure?

Main Street Bank has taken many steps to make sure you are protected online:

- 256-bit Secure Sockets Layer (SLL) technology. To access your accounts, you must use a browser that supports a 256-bit encryption.

- A User ID and Password are required every time you login. Your sign on information is used for accessing your accounts online – never share them with anyone.

- The computers that run our site are protected by firewalls, which are systems that prevent unauthorized access to our network. They are constantly monitored to prevent security breaches.

- A Main Street Bank online session will automatically end, or “time out”, if you do not perform any transactions for twenty minutes. To resume your session, you will have to log back in to Online Banking.

- When using a new device to log into Online Banking for the first time, an additional level of security is added with an automated phone call to the primary phone number for you, SMS text message to the primary cell phone number for you, or additional “out-of-wallet” questions must be answered before being prompted to enter your password.

How do I use Mobile Deposit?

Mobile Deposit allows you to deposit checks into your Main Street Bank account using your smart phone (iPhone or Android) or iPad. Before you can start using Mobile Deposit, you’ll need to make sure you have the Main Street Bank installed on your mobile device. You can download the app using the following links:

Remember, all checks deposited through mobile deposit with the Main Street Bank mobile banking app must be endorsed with, “For mobile deposit at Main Street Bank” followed by the depositor’s signature. This will ensure that the check is deposited in one account only, and cannot be duplicated for deposit at a different institution.

If you have any questions about our mobile deposit service, please call us directly at 508-481-8300.

What are the interest rates at Main Street Bank?

All of our current deposit rates can be found under Deposit Rates.

All of our current consumer loan rates can be found under Loan Rates.

All of our current mortgage rates can be found in our Mortgage Center.

What are Main Street Bank’s account fees?

While we offer free account options for both consumers and businesses, there are some standard one-off account fees that can apply in specific situations. For a list of all of our retail and business account fees, please review our Summary of Fees below.

Our Retail Summary of Fees outlines any fees associated with consumer deposit accounts.

Our Business Summary of Fees outlines any fees associated with business and commercial deposit accounts.

Our Cash Management Summary of Fees outlines any fees associated with Cash Management deposit accounts and services.

Where do I mail my loan payments to Main Street Bank?

Loan payments made payable to Main Street Bank can be sent to the following address:

Main Street Bank

PO Box 986541

Boston, MA 02298-6541

This address may also be used for electronic payments made with another financial institution’s online banking program. For any questions about your loan payments, you can contact our Loan Operations department at 508-481-8300 or [email protected].

Can I make change at Main Street Bank?

For individuals and businesses that have a deposit or loan account with Main Street Bank, we will make change for money in any amount. This means exchanging a $100 dollar bill for 5 $20 dollar bills, turning in smaller bills for larger ones, exchanging paper bills for coins, or any other combination of exchanging money.

Main Street Bank’s policy is to not exchange currency above the amount of $50 with anyone who does not have a deposit or loan account with the bank. We enforce this because:

- This protects the bank and our customers from possible counterfeit currency or currency used for fraudulent/illegal purposes.

- We are unable to trace currency back to those who do not have an account at the bank.

- Most financial institutions have a similar policy.

We appreciate your understanding of our obligation to protect our customers and the bank from potential risks.

Does Main Street Bank exchange foreign currency?

Main Street Bank does not exchange foreign currency. One option for traveling abroad and making payments without carrying cash on you is using a Main Street Bank Debit Card. This is a safe and convenient alternative to carrying cash or checks.

If you are traveling, be sure to let us know where you will be going and what dates you will be traveling. Call us at 508-481-8300, or send us a secure message through online banking to tell us when and where you are traveling.

How do I apply for a job at Main Street Bank?

As a community bank, we strive to work with talented and dedicated people, create a strong culture, be a responsible neighbor, support each other, inspire the best customer experience…you get the idea. With fulfilling careers and competitive benefits, our professionals enjoy their work, know it inside and out, and are committed to the customers and communities they serve. That’s why careers at Main Street Bank are rewarding for both our employees and our customers. Our people are our greatest asset.

Our open positions are posted regularly on our Careers page. You can apply for the position you’re interested in online.

If you have any questions about a career at Main Street Bank, please call us at 508-481-8300 and ask to speak to our Human Resources department.

Main Street Bank is an Equal Opportunity Employer. Individuals with disabilities and veterans are encouraged to apply.